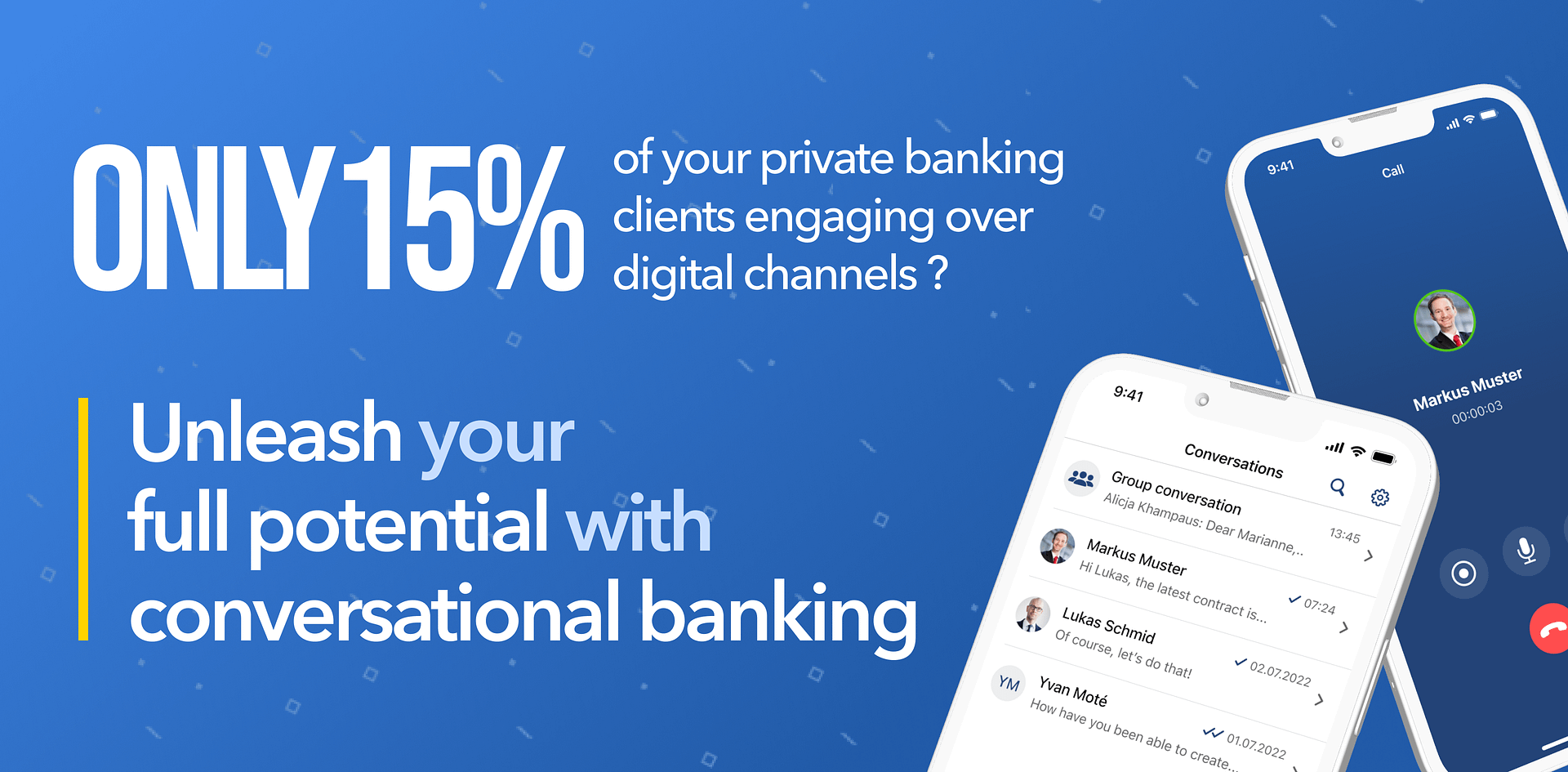

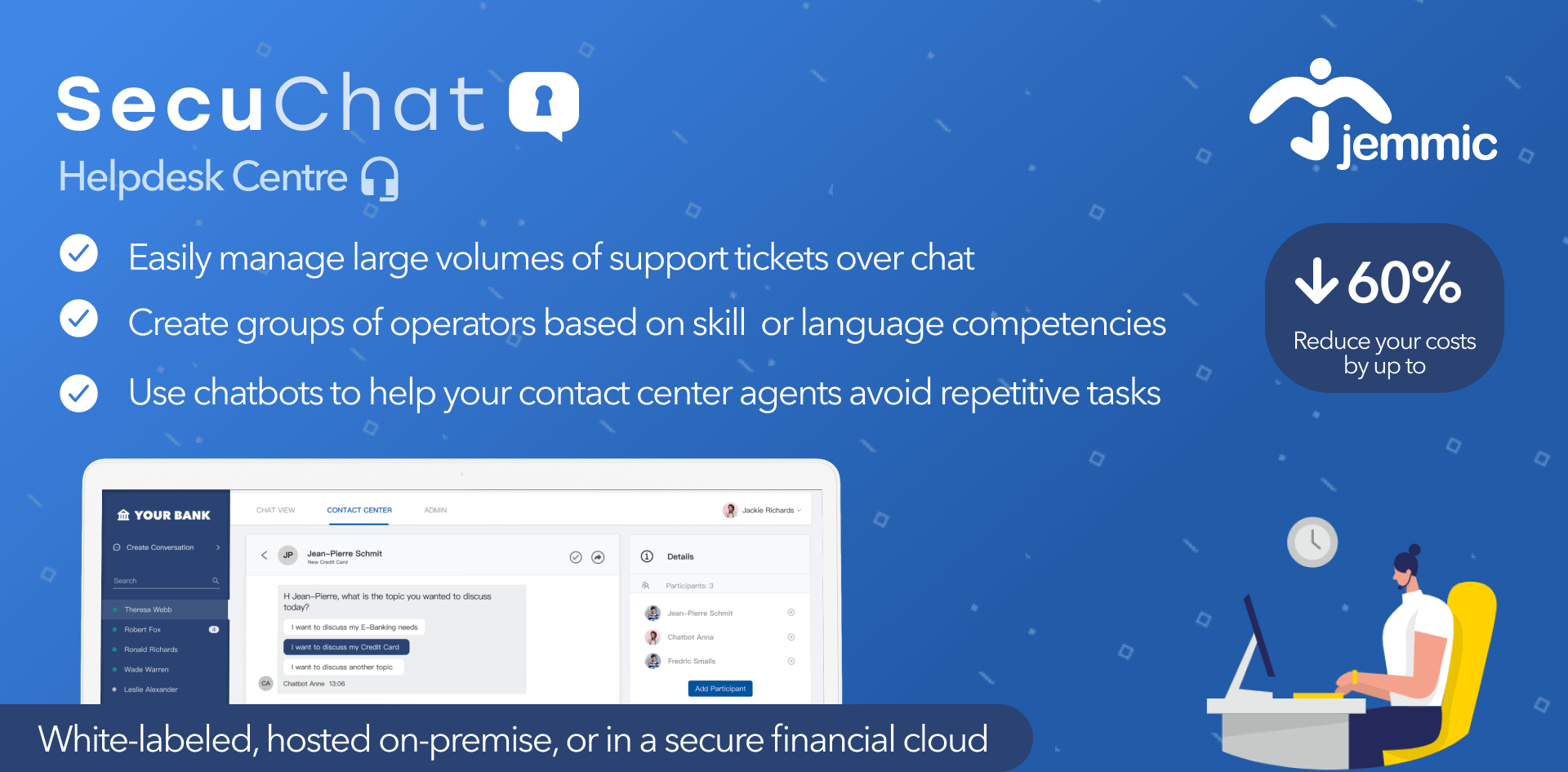

When and how to transition clients from Whatsapp to a secure chat?

You did it ! You attracted potential clients with an open-to-everyone Whatsapp contact number, and you now are engaging with a prospect that you want to convert to a client. According to the Whatsapp terms & conditions, communication is end-to-end...